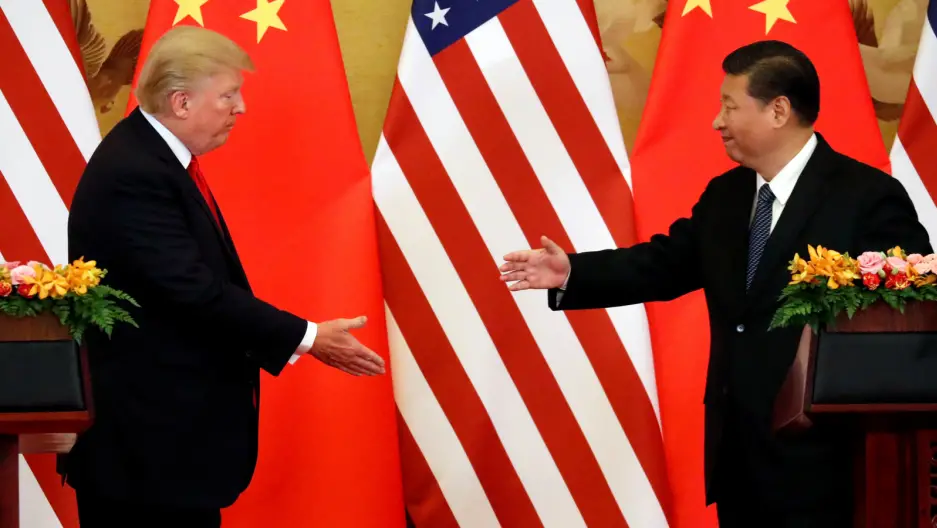

People have said that it makes sense for us to raise the trade war with China since they sell us so much more than we buy from them. (We don’t usually mention that it’s largely American corporations that are benefiting by producing there and selling here.) The argument is that the Chinese have no “ammunition” in the “war.” Maybe, maybe not.

Reuters notes that we are vulnerable because we have such enormous debt—and the Chinese own much of it.

Should China, Japan and other nations, which have recycled their trade dollars through their Treasuries holdings, suddenly decide to whittle them down, markets could be in for a rough ride.

Such a retaliatory move, in the wake of Trump’s first big protectionist action, comes at a time when foreign demand for U.S. debt is seen critical to offset an expected surge in federal borrowing needs, analysts and investors said on Friday.

“The threats are real,” said Kristina Hooper, chief global market strategist at Invesco in New York. “We need more foreign demand, not less.”

This is important because the national debt, which was less than $5 trillion in the Clinton Administration, has now topped $22 trillion.

The Hill warns about the dangers of trade wars.

Retaliation was quick in coming, contributing to an astonishing two-thirds reduction in U.S. trade with Europe between 1929 and 1932. . .

History shows that trade wars often spill over into broader economic, diplomatic and even military conflict. Before engaging in a trade war, it would be wise to assess one’s vulnerabilities to forms of pressure and modes of conflict beyond the narrow field of trade. Have our leaders done this?

What might the results of a sell-off of American debt be?

according to The South China Morning Post, China has its own “range of financial firepower at its disposal to punish the US” for the tariffs war, including its massive $1.123 trillion piggybank of US Treasury bills.

Theoretically, if China were to dump this debt onto the market, US bond prices would drop and force the government to substantially increase yields. That, in turn, would make loans for US corporations and private borrowers more expensive, cooling US growth.

As it turns out, the dumping may have begun.

Putting it another way – they’re dumping U.S. bonds. . .

“China’s ownership of U.S. bonds, bills and notes slipped to $1.17 trillion, the lowest level since January and down from $1.18 trillion in June.”. . .

I believe China may be selling just enough to get the attention of Trump and the Treasury. A soft warning for them not to take things too far with tariffs and trade.. . .

Long story short: the U.S. is running huge deficits. They haven’t been this big since the Great Financial Recession of 08.

The Russians are also dumping, according to Money.

Between March and May, Russia’s holdings of US Treasury bonds plummeted by $81 billion, representing 84% of its total US debt holdings.

The sudden debt dump may have contributed to a short-term spike in Treasury rates that spooked the market. 10-year Treasury yields topped 3% in April for the first time since 2014.

China and Russia are not the only sellers.

Many foreign countries have decreased their demand for US government debt. Even China, which holds more US debt than any other country, has lowered its US Treasury debt from 14 percent to 7 percent. There is little chance that China will dump all of its US debt at once. If it did, the US dollar would collapse and severely affect international trade. Still, there appears to be a trend. . .

While they are ridding themselves of US debt, global central banks are embracing the purchase of gold. Much of this gold rush is an effort to erode the dominance of the US dollar on the global market. In 2018, central banks bought over 650 tons of gold. This is up 74 percent from 2017 gold purchases. Russian, India, Hungary, and Turkey were the most significant gold investors.

RealMoney notes that while other countries have been selling, Saudi Arabia has been “saving our bacon.” Might that explain why Trump has refused to condemn the Saudi’s for torturing and dismembering an American resident? Or the recent mass beheadings and crucifixions? Or the fast-tracking of nuclear technology to the country? Or the selling of a huge amount of arms to them, even though Congress has “forbidden” it? Or the rest?

China, Japan and Russia are all sellers vs. Saudi Arabia as buyers. This has driven the global share of USD reserves to its lowest since 2013. . .

Given the focus of U.S. foreign policy, it is no surprise to see these numbers — nor the trends. The U.S. is alienating its trading partners and forcing them to tie up with others to re-establish their alliances. As there is a pickup in yuan trading in gold, oil, and metals, it is no surprise that Trump is hell bent on trying to cripple China as he fears their growth and regional dominance following the One-Belt-One-Road initiative.

The Washington Times says China owns more of our debt than we thought.

the Asian economic giant almost certainly owns far more Treasury securities than official statistics indicate. . .

“The U.S. Treasury data almost certainly understate Chinese holdings of our government debt because [the U.S. figures] do not reveal the ultimate country of ownership when [debt] instruments are held through an intermediary in another jurisdiction,” Simon Johnson, an economics professor at the Massachusetts Institute of Technology, told the U.S.-China Economic and Security Review Commission, . .

America’s military superiority may not be enough.

Maj. Gen. Luo Yuan told China’s state-run Outlook Weekly magazine last month, shortly after the U.S. detailed new arms sales to Taiwan, that China’s “retaliation should not be restricted to merely military matters” but also should be “covering politics, military affairs, diplomacy and economics.”

“We could sanction them using economic means, such as dumping some U.S. government bonds,” Gen. Luo said.

CNBC calls dumping of American debt a “nuclear option” that would disrupt international markets, as well as their own, but in recent years, we have seen several “nuclear options” instituted, because sometimes, power seems more important than well-being.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts