The topic of student loans and educational debt spawning from the ever-increasing cost of higher education has been a topic discussed during every modern presidential campaign in the past twenty years. There is always some push by candidates on both sides to “make college affordable” or some generic rhetoric. Everyone agrees that college costs are out of hand, and many students wind up with a degree they can’t pay for which hampers their financial lot for the next decade or more once they exit school. However, after that, the parties diverge on how much the federal government should be involved in the issue.

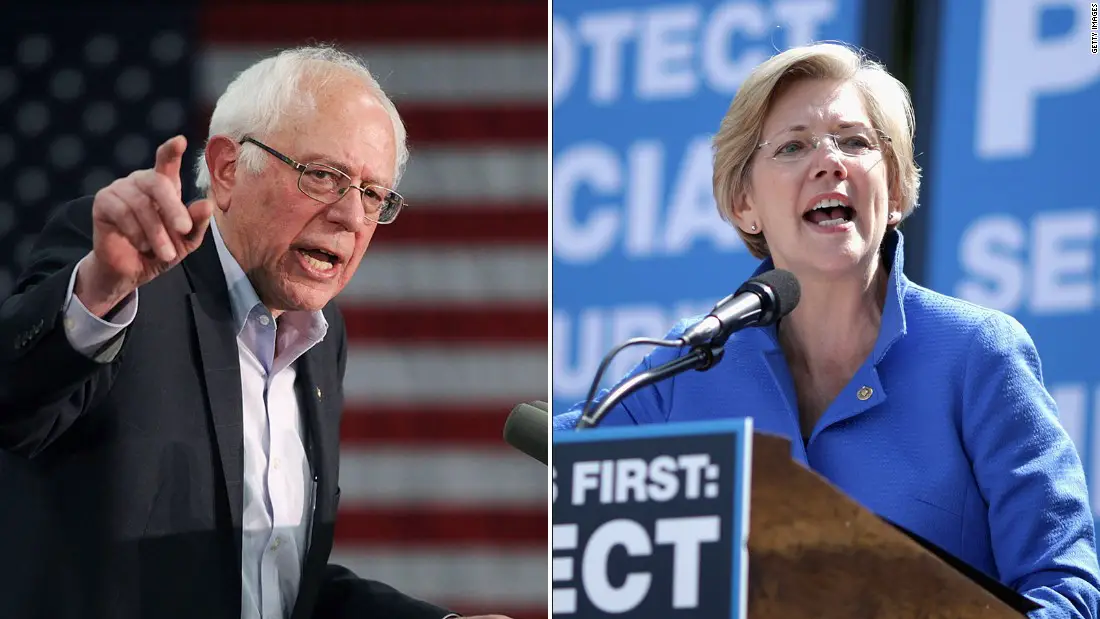

The topic gained more notice this month with a plan from Sen. Elizabeth Warren released less than two weeks ago that would eliminate up to $50,000 of student loan debt. Not to be outdone, Sen. Bernie Sanders, rushing to get his plan out before the first Democratic debate this week, also pushed a proposal which goes beyond the scope of Warren’s plan to include all student loan debt of every type and every amount.

Warren would cancel up to $50k in student debt

MarketWatch offers this brief outline of the Warren plan and what it entails:

Under the proposal Warren released as part of her presidential campaign in April, borrowers with a household income of less than $100,000 would have $50,000 of their student debt cancelled and borrowers with an income between $100,000 and $250,000 would be eligible for some student debt cancellation — though not the full $50,000. Borrowers earning $250,000 or more would receive no debt cancellation. Her campaign estimated the plan would cost $640 billion, which would be paid through a tax on the ultra-wealthy.

Warren’s plan intentionally put caps on household income and caps on the amount of debt that could be forgiven so as to avoid a scenario where students seeking Graduate-level degrees, such as med school or law school, wouldn’t disproportionately benefit from the program. MarketWatch also notes that economists agree that some kind of debt forgiveness plan could spur growth by basically injecting more disposable income into the economy but also not it would come at a cost to taxpayers and could bring other unintended consequences.

Bernie doubles-down by canceling all student debt

Looking at Warren’s plan, Bernie decided that he would try to one-up the $50,000 limit by proposing a blanket plan that would eliminate all student loan debt, both public and private, from the books in entirety. As Politico reports, Bernie says the cost would be some $2.2 trillion over ten years and would come from a tax on Wall Street speculation:

Sen. Bernie Sanders on Monday proposed eliminating all of the nearly $1.6 trillion in outstanding student loan debt owed by Americans, raising the stakes on an issue that has increasingly animated the progressive base of the Democratic party.

Sanders’ call for completely eliminating existing student loan debt is sure to rekindle divisions among progressives and Democratic primary voters more broadly over whether sweeping new government benefits should be available to all — or targeted to low- and middle-income families.

But Sanders pushed back on that potential divide during a press conference outside of the Senate on Monday morning, saying he believes education is a right to everyone, regardless of income.

“The overwhelming majority of the people who are going to benefit from this legislation are working-class people,” Sanders said, surrounded by progressive lawmakers, including Reps. Pramila Jayapal (D-Wash.), Ilhan Omar (D-Minn.) and Alexandria Ocasio-Cortez (D-N.Y.), who are filing a companion bill to Sanders’ proposal in the House.

Sanders said he believes in “universality,” but that he aims to make sure his proposal doesn’t benefit the wealthy by demanding “that the wealthy and large corporations start paying their fair share in taxes”

Bernie’s plan is rather straight-forward since it applies evenly across the board. No income limits, no debt limits, no exclusions for anyone wishing to have their student loan debt forgiven.

Despite Bernie classifying his plan as being fairer to everyone, critics point out that with no income limits, even the wealthiest of individuals can have their student loans forgiven whether they’re struggling financially or not. Bernie acknowledged this point but explained that, in his view, higher education is a right deserved by all:

“And that means that if Donald Trump wants to send his grandchildren to public school, he has the right to do that,” he said. “What we are saying today is public colleges and universities should be tuition-free and debt-free for all Americans.”

The lawmakers pitched the effort as a “bailout” for millennials and the working class, funded by Wall Street.

“The American people bailed out Wall Street. It’s time for Wall Street to bail out the American people,” Omar said, echoing Sanders’ comments from a campaign event Sunday at Clinton College in Rock Hill, S.C., where he argued that “if we could bail out Wall Street, we sure as hell can reduce student debt in this country.”

Politico also notes that during the 2016 election, Bernie took issue with Hillary Clinton on this very matter where the two disagreed on the scope of such a plan:

Sanders previously called, during the 2016 presidential campaign, for eliminating tuition at public colleges and universities for all students. He sparred over that issue with Hillary Clinton, who attacked his plan for subsidizing wealthy families who can already afford to pay for college. Sanders ultimately backed a compromise with Clinton ahead of the 2016 Democratic convention that called for limiting free public college tuition to families earning less than $125,000.

Warren’s decision to cap her plan has a distinct angle and strategy to it. It’s a signal that she’s on board with canceling some portions of student debt, but not in a way that, in her opinion, would reward the wealthy at the same time. In other words, she’s playing to voters who may generally support the idea, but don’t support unfettered “universal” elimination of all student debt.

Other candidates taking a moderate approach

Simply canceling large amounts of student debt can be seen as an extreme position for a variety of reasons, not the least of which is the cost involved and the way it disproportionally benefits people who go to college over people who don’t. Other candidates have chimed in the matter, though few have taken to advancing actual debt cancellation plans like Warren or Sanders:

Critics of the debt forgiveness on both sides of the aisle have said that it would provide large benefits to higher-income families who have student loan debt from expensive graduate degrees.

Other Democratic candidates, such as Mayor Pete Buttigieg, have positioned themselves as more moderate on the issue, saying that canceling student loan debt unfairly benefits those who go to college over those who don’t. Sen. Amy Klobuchar (D-Minn.) has rejected the idea of free tuition at four-year colleges as unrealistic and too expensive, though she supports free community college.

This issue will be discussed during the debate this week, although Warren and Sanders appear on different nights so they won’t be able to directly discuss their plans in person to one another. Regardless, they’ll both be asked about their plans and about why they have some key differences.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts