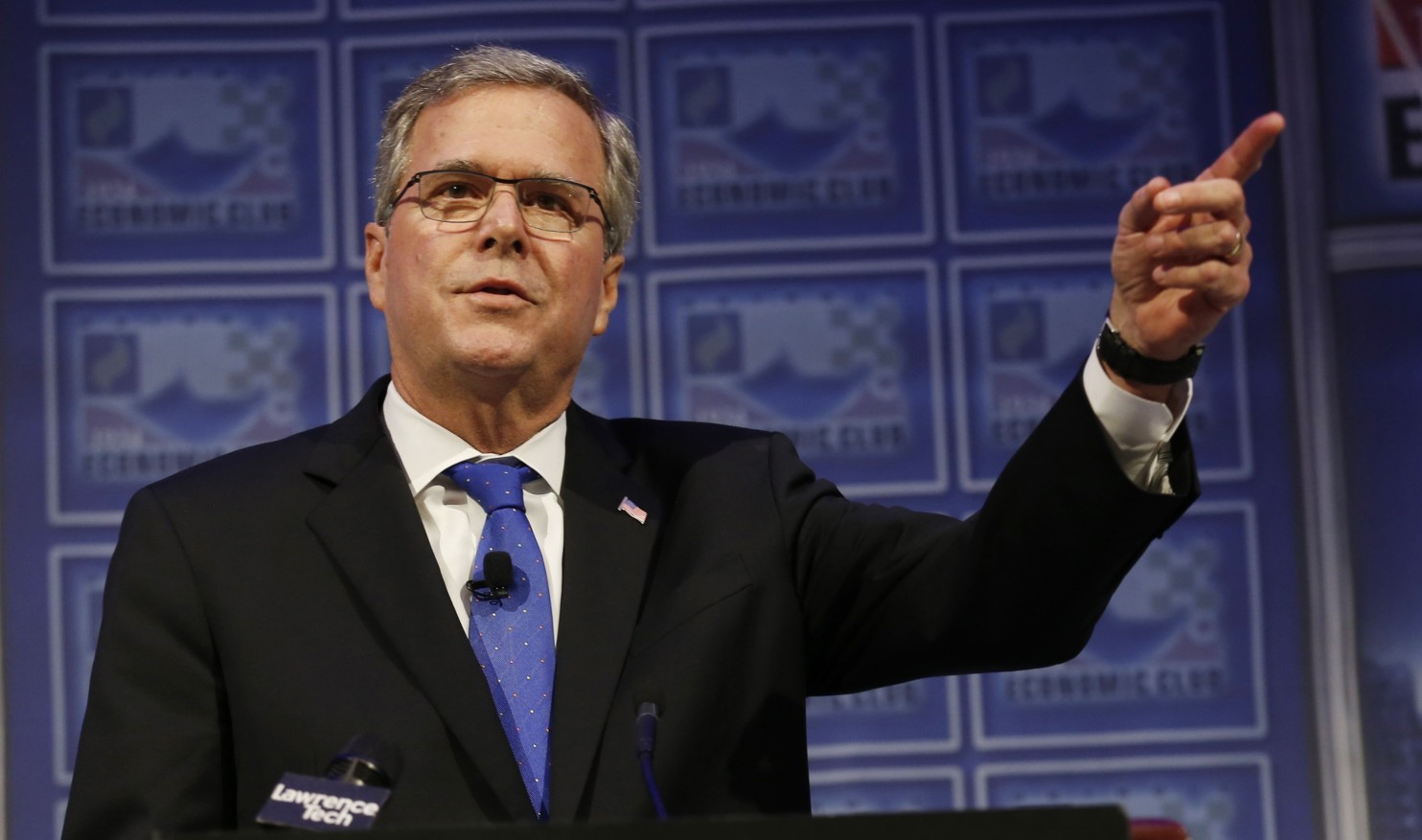

Many candidates have attempted to avoid or soften their approach to the question of immigration reform within the GOP’s 2016 field. Jeb Bush has tried to take the issue on with some statements offering support for various aspects of guest worker programs, border security, and a desire to see some kind of immigration bill come out of congress soon. Apparently, many donors like what they hear and would like to hear more of it from other candidates.

Report from The Hill:

Top Republican donors and party strategists are urging prospective 2016 GOP candidates to follow former Florida Gov. Jeb Bush’s lead on immigration reform.

Spencer Zwick, the finance chairman for Mitt Romney’s 2012 presidential run, was among the GOP heavyhitters on a conference call Tuesday who praised Bush for taking a stand on the issue.

“Gov. Bush has decided to lead on this issue,” said Zwick. “It’s very early in the campaign process. We have not yet heard from every potential or likely presidential candidate [but…] I give Gov. Bush a lot of credit.”

The donors didn’t go into a specific critique or endorsement of Bush’s immigration policies, but their message was clear: the 2016 presidential candidates must strike a more moderate tone on the issue and avoid controversial “fringe” remarks to appease to the far right during a primary if they want to win the White House.

Zwick, who has yet to signed onto any prospective Republican candidate, said that if another GOP candidate “wants to be taken seriously, they need to be in a similar place.”

Bush is largely seen has having more moderate immigration policies, which puts him at odds with the more conservative GOP factions.

Earlier Tuesday, Bush criticized President Obama for overstepping his presidential authority on immigration. He has previously argued that reforming the nation’s immigration system would help the nation’s economy.

As far as many donors are concerned, any prospective candidate must take a moderate tone and espouse moderate views on this topic to be taken seriously in a White House bid. Of course, this runs at odds with much of the conservative base who would take a harder line on immigration and border security. The difference maker will be how well Jeb, or other moderates on this topic, can explain themselves and make a case for a “comprehensive” immigration policy which contains some provisions conservatives loathe.