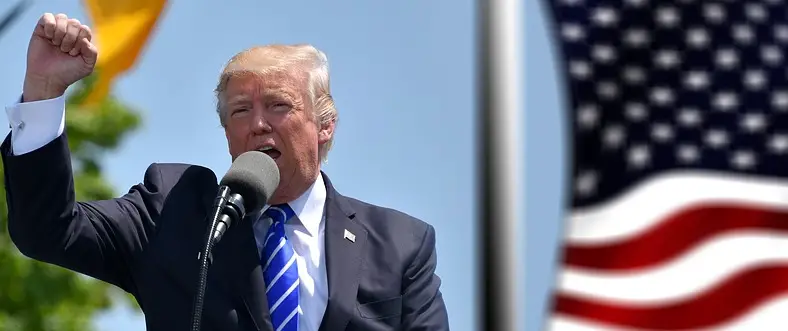

During his election campaign President Trump promised to put “America first.” In his first year in office, the president, along with his cabinet, have rolled out some divisive measures that, while appealing to his core base, have impacted the financial markets.

The Iran Sanctions

The U.S.’ relationship with the Middle East has been fractious, and as we reported President Trump has caused further divisions by withdrawing from the Iran nuclear deal. By going against the wishes of the international community and imposing sanctions on Iran, Trump has potentially undermined the dominance of the dollar.

Countries that oppose the U.S. decision to withdraw from the treaty are looking to replace the dollar in transactions with either the Yuan or Euro, in order to continue trading with Iran. This could be the start of the world reducing its dependence on the U.S. dollar, which would weaken the value of the currency.

Friction-fueled slump

Rising tensions between China and the United States battered stocks in May as investors scrutinized the trade war between the two powerhouse economies. Markets began to slide and job growth also slowed down after President Trump threatened to increase China’s tariffs.

President Trump claims that the stock market has been on the rise ever since he took power but the financial market’s current performance is showing otherwise. The tension between the two countries is fueling the sluggishness of the market, with the S&P 500 now down at 2.6% for the year. Based on binary options’ historical price chart, the S&P 500 lost 9% of its late peak in January.

Binary options are trading tools that track the prices of commodities, stocks, and indices. Multiple markets can be tracked by binary options according to Nadex, and the charts are showing that other indices have experienced lows, too. Japan’s Nikkei 225 saw a 0.4% drop in May, while Hong Kong’s Hang Seng declined by 1%. Europe’s France CAC-40, Britain’s FTSE 100, and Germany’s DAX also ended up lower than the previous month.

Steel and Aluminum Tariffs

Apart from the U.S.’ friction with China, the metals market is also gaining a lot of volatility lately because of President Trump’s new tariffs on metal. In the U.S., aluminum and steel imports now have a 10% and 25% tariffs respectively.

Trump has stood by the tariffs even if some of his Republican allies have shown disappointment with the new levies. As a result of the tariff against aluminum and steel, China is now preparing for a trade war with the U.S. This has resulted in a sharp stock market sell-off in the U.S. and China, with the value of industrial stocks, such as Boeing, falling.

The issue of tariffs has also led to a potential trade war with EU. This would affect metal suppliers all over the world and lead to the U.S. losing potential suppliers. Unless the U.S. has enough steel to sustain its projects and demand, the country will be paying more for the purchase of metals in the long run.

Despite the decline of different financial markets, President Trump remains positive that he will make the U.S. economy great again.

“I’m not saying there won’t be a little pain,” said President Trump. “…but we’re going to have a much stronger country when we’re finished.”

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts