Who’s to blame for the Silicon Valley Bank collapse? The short answer is that it’s complicated, but the blame being passed around within most circles isn’t accounting for the poor state of economic fundamentals under Biden’s watch.

Day after day, as companies tighten their belts, layoffs ensue, and capital dries up, the banking system is finally finding itself under the crunch of the Biden administration’s chaotic mismanagement.

Understanding the nuts and bolts of the Silicon Valley Bank (SVB) collapse is fairly straightforward. The bank itself operated as an inverse of most regional or even megabanks. Your local bank probably has somewhere in the range of 80-90% of depositors who would be covered under the $250,000 FDIC insurance which guarantees your money is safe even if the bank disappears tomorrow. Most people don’t have that much cash in their checking or savings accounts. Maybe they have as much tied up in other assets like stocks or real estate, but they don’t typically have a few million dollars in a readily-accessible checking, savings, or money market account.

At SVB, only around 5% of depositors had balances less than $250,000 because this bank dealt with large account holders and extremely high account balances. It was a haven for tech startup capital. On the surface there’s nothing wrong with that, most banks, most of the time, are stable and manage their assets well. The SVB collapse is an exception to this rule.

This is where I’ll let David Sacks of The Federalist pick up the story, he can explain it better than I can:

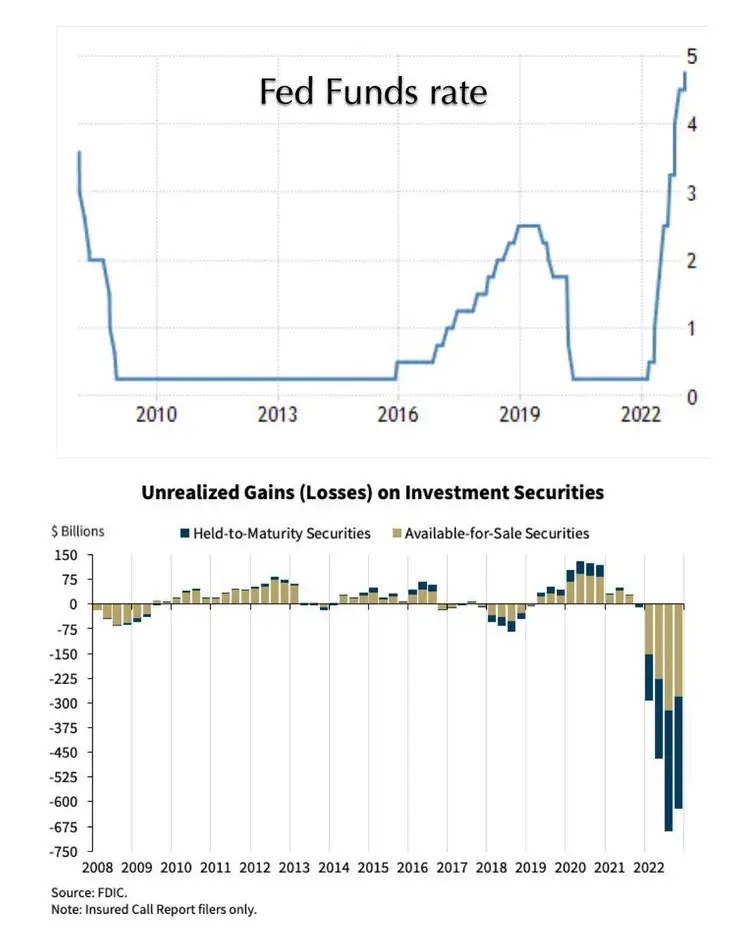

If you want to understand the context for the crisis, look at the Federal Deposit Insurance Corporation chair’s March 6 testimony — a week before Silicon Valley Bank’s collapse — where he explains that banks were sitting on $620 billion of unrealized losses from long-dated bonds. This provided the tinder for the crisis.

The match was lit when SVB announced on Wednesday, March 9, that it had effectively sold all of its available-for-sale securities and needed to raise fresh capital because of large unrealized losses from its mortgage bond portfolio.

On Thursday morning, the financial press widely reported SVB’s need for new capital, and short sellers were all over the stock. The CEO’s disastrous “don’t panic” call later that morning only heightened fears and undermined confidence in the bank.

Its collapse was first and foremost a result of its own poor risk management and communications. It should have hedged its interest rate risk. And it should have raised the necessary capital months ago through an offering that didn’t spook the street.

But it’s important to understand that SVB’s failure didn’t arise from risky startups doing risky startup things. It arose from SVB’s over-exposure to boring old mortgage bonds, which were considered safe at the time SVB bought them. Perhaps this is why SVB had an “A” rating from Moody’s and had passed all of its regulatory exams.

What turned the mortgage bonds toxic? The most rapid rate-tightening cycle we’ve seen in decades. You can see the connection here between rapid rate hikes and unrealized losses in the banking system.

In other words, and to further explore this point, banks got a sugar high off all the Covid money floating around and some of them, like SVB in particular, didn’t manage the times of plenty well in order to weather the times of need. The value of SVB’s bonds was sent tumbling over the past 12 to 24 months as Biden’s inflation ravaged the economy.

As a result, the bank sold billions of dollars worth at great losses in a panic to make up for its liquidity issues. This type of move, despite a plea from the CEO not to panic immediately caused panic because good banks don’t operate this way.

This accompanying chart is quite an eye-popper when it comes to understanding why SVB’s assets went into a freefall along with serving as a warning for what could be on deck for other banks:

As Sacks concludes, where did this record inflation come from? Why, Joe Biden’s economic and legislative agenda, of course:

So what caused the rapid rate hikes? The worst inflation in 40 years. And what caused that? Profligate spending and money printing coming out of Washington — all while Joe Biden, Janet Yellen, and Jerome Powell assured us inflation was “transitory.”

I warned two years ago that pumping trillions of dollars of stimulus into an already hot economy was an unprecedented and likely dangerous experiment. But this was Bidenomics.

The White House is now hunting for a scapegoat and they’re going to be blaming everyone but the man in the Oval Office. The “smartest people in the room” who ignored warnings from honest economists in 2021 about rampant inflationary policies are now cleaning up the mess they’ve created.

In retrospect, SVB never should’ve been operating on the edge of solvency for so long and should’ve moved to sure up its position months ago, not wait until the bitter when panic-driven decisions set off a run of depositors desperate trying to take their money out.

While it’s true that SVB was heavily involved in the woke politics of the left, that’s ultimately not the reason the bank failed. It’s also true that among SVB bank leadership, few of them had any real banking experience, perhaps another red flag along the way.

The downfall of SVB lies ultimately with Biden’s economic policies that made the bank’s safe bonds assets suddenly become risky and begin to deteriorate.

This is another Biden-caused disaster despite the warnings and truth staring everyone in the face.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts