In other words, when college tuition inevitably continues to climb at an explosive rate, then and only then will supporters of student loan forgiveness realize what they’ve done.

It’s one of those ideas that sounds nominally good on paper until you apply some kindergarten logic and reason to the question.

Should the government start canceling or forgiving college student loan debt? Sure, why not! Student loans suck!

What if it makes college more expensive? Well, maybe not.

What if your tax dollars go up to pay for it? Well, um, maybe.

What if more employers start requiring college degrees for jobs where it’s unnecessary? Well, that’s not good.

It’s a feel-good issue for the Biden administration like handing out candy without concern for what happens when the sugar high wears off.

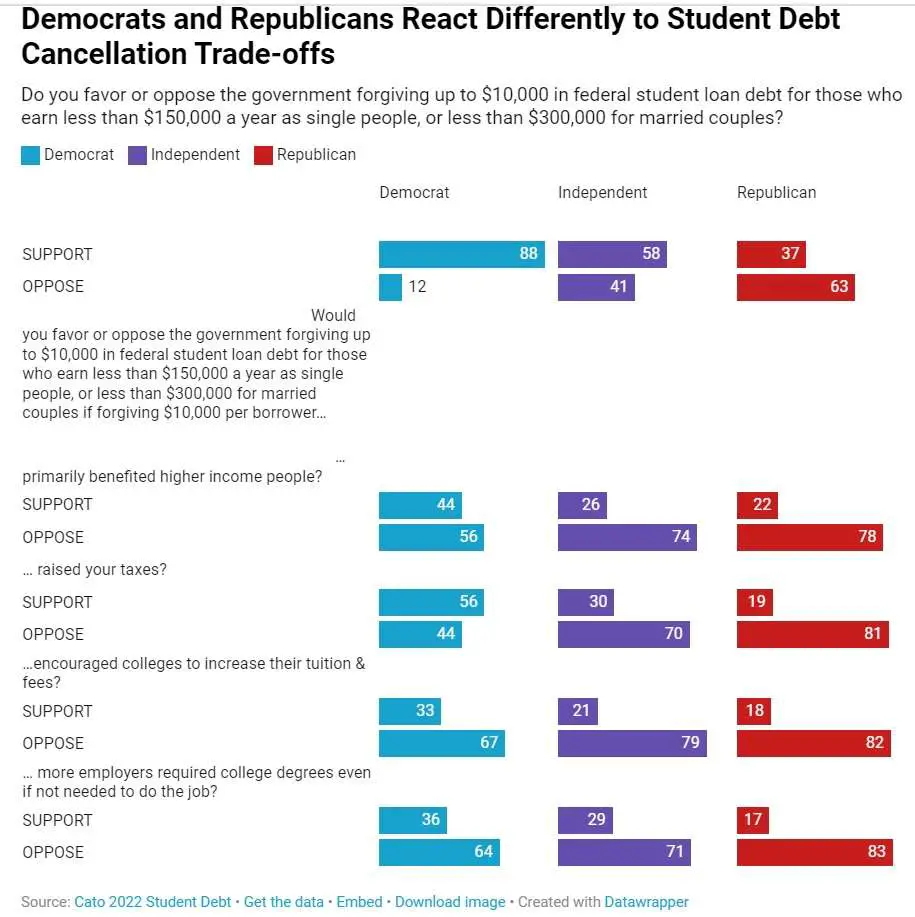

A new poll from the CATO institute in tandem with YouGov posed some difficult questions to supporters of student loan forgiveness and the results make you realize the limited amount of thought some voters give to an idea before they sign on to it:

As Reason magazine explains the data, support for student loan forgiveness drops precipitously when potential consequences are introduced into the discussion:

“Support for cancelling federal student loan debt plummets when Americans consider its trade-offs,” writes Emily Ekins, director of polling for the libertarian Cato Institute, which published polling data on student debt forgiveness Thursday. The Cato/YouGov survey includes more than 2,300 Americans and was conducted over six days in mid-August, just prior to the White House’s August 24 announcement of the student loan forgiveness plan.

The results are striking. While 64 percent of respondents (and 88 percent of Democrats) back student loan forgiveness of $10,000 for individuals earning up to $150,000 annually, those totals fall significantly once potential consequences are introduced.

Rising college tuition costs fueled by what is essentially free government money will be the most likely outcome if Biden’s student loan forgiveness plan makes it past the legal challenges. As we previously noted, the plan resembles a bait-and-switch promise to midterm voters that looks unlikely to survive legal scrutiny, but voters will be left holding the bag if it fails.

If Biden’s plan somehow does survive, it’ll be future college students on the hook for higher tuition costs that seem to have no ceiling in the near future.

The plan received mixed reviews up front with several Democrats expressing their dismay and some even asking, “what the f*ck is Biden doing?”

It’s not hard to envision a world where government spending and “free” money lead to economic calamity like record inflation, we’re currently living in it. Now just imagine the current inflationary rate doubles, perhaps, if Democrats continue down the tax and spend road to bloated government and handing out cash like drunken sailors.

We’re probably well past that point but every new spending plan, which is exactly what the student loan forgiveness plan is, brings more money into the economy and thus provides more dry wood for the inflation fire to eat up.

Biden is counting on voters who won’t think too hard about his plans or what they might lead to.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts