A detailed view of where and how the IRS spends its time auditing taxpayers should give anyone pause when considering the agency wants to add 87,000 new agents to its ranks.

You’d think, since it’s endlessly repeated, that the IRS would spend time auditing and targeting only wealthy individuals and corporations. Those who stand to gain by using the tax code to hide income in shell companies or claim credits they’re otherwise not entitled to.

That’s not the case in practical terms, however, where data shows most audits happen to individuals earning less than $20,000 per year and who claim the Earned Income Tax Credit. In other words, the people who can least afford an audit and can least afford to spend money on representation to help them fight an audit or spend the time dealing with it.

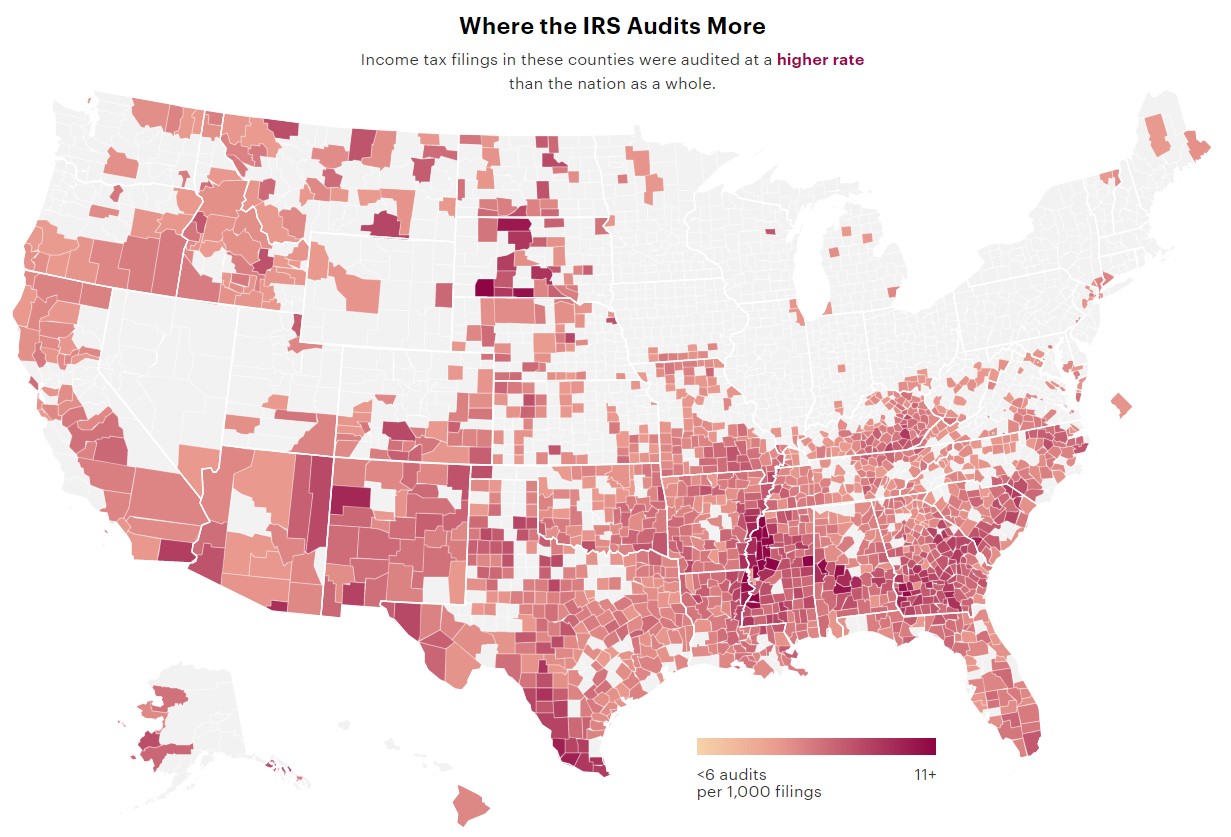

This map, courtesy of ProPublica, shows the “hot spots” around the country that disproportionately receive the vast majority of IRS audits.

The overriding theme is that the areas claim more low-income inhabitants and are predominantly black:

As MarketWatch reported in 2020, there’s a specific reason for this trend and it has to do with the complexities of the federal tax code:

As MarketWatch reported in 2020, there’s a specific reason for this trend and it has to do with the complexities of the federal tax code:

One thing these poorer communities have in common is that many residents claim the earned income tax credit (EITC), an anti-poverty program for low- to moderate-income working individuals and couples, particularly those with children.

And while the general rule is that the more money you make, the more likely you are to be audited, it turns out that EITC recipients are the exception: The IRS audits EITC recipients, whose annual income usually falls under $20,000, at higher rates than all but the richest Americans. EITC recipients were audited at twice the rate of taxpayers with income between $200,000 and $500,000 in 2017.

It’s also a question of efficiency in a government agency that is often overworked and ask to deal with the impossible task of annually adjusting its regulations and procedures based on the whims of a temperamental Congress:

The Treasury Inspector General for Tax Administration (TIGTA), an IRS watchdog, also reported in May that the IRS is ignoring hundreds of thousands of delinquent high-income taxpayers who owe billions of dollars in total. Between 2014 and 2016, the top 100 high-income nonfilers (taxpayers who don’t file a required tax return or pay their tax due in a timely manner) whom the IRS did not send delinquency notices to, and whose cases were simply shelved, owed about $9.9 billion in total taxes.

The bottom line is that auditing a low-income household is, well, easier than auditing a high-income household.

It’s the path of least resistance that speaks to how broken and corrupt the entire tax code has become. Rather than alleviate the complexities, Congress piles on more complexity year after year with new credits and adjusted levels of how to claim credits.

As a result, those who cannot afford to pay for professional tax filing or afford to spend the time making sure things are filed accurately pay the price for a poorly written tax code.

Another report on the issue from Salon explained that it’s also a matter of auditing an “overpayment” versus auditing some kind of unreported income.

On paper it’s easier to investigate an overpayment:

Despite this trend, audits of those earning between $500,000 and $1 million have dropped by 71 percent since 2011 and audits of those earning between $200,000 and $500,000 have dropped by 74 percent, according to ProPublica.

Nina Olson, the national taxpayer advocate, told the outlet that the IRS’s focus on “improper payments” to the poor over unreported income was misguided.

“What’s the difference between an erroneous EITC dollar being sent out and a dollar attributed to unreported self-employment income not collected?” she asked, adding that unreported business income is “where the real money is.”

In the hilariously named Inflation Reduction Act, the Biden administration is set to authorize the IRS to hire some 87,000 new agents specifically to beef up the agency’s ability to audit.

Despite assurances that individuals making under $400,000 would see no increase in audits, the problem is with the wording. Those making under that amount already receive the bulk of the audits and they have since the early Obama years.

Analysis of the new legislation says that those making under $75,000 a year will face the brunt of new IRS audits that result from Biden’s new legislation:

Americans who earn less than $75,000 per year are slated to receive 60% of the additional tax audits expected under Democrats’ spending package, according to an analysis released by House Republicans.

The analysis, which is a conservative estimate based upon recent audit rates and tax filing data, shows that individuals with an annual income of $75,000 or less would be subject to 710,863 additional Internal Revenue Service (IRS) audits while those making more than $1 million would receive 52,295 more audits under the bill. The legislation, the Inflation Reduction Act, would roughly double the IRS’ budget to increase enforcement and, therefore, federal tax revenue.

Once again, rather than attempt to simplify the tax code, Democrats have decided to beef up the IRS enforcement of an arcane and difficult system that clearly harms those who can least afford the harm.

The lie that households earning less than $400,000 will see no increased audit activity doesn’t hold up to scrutiny based on the facts of how the IRS works.

Don’t worry though, the Biden family will be safe from audits leaving Hunter Biden in the clear.

Donate Now to Support Election Central

- Help defend independent journalism

- Directly support this website and our efforts